CBSE Class 12-commerce Answered

In NPO que no 10 ...why we will not take or substract 2017 outstanding subscription of rs 8000 in calculation of current year subscription. And also in que no 11why we will not substract 2016-17 arrear 10,000 in calculation of subscription. But in que no 12 in casie V V (ii) why 2017 outstanding subscription at the end substract in calculation of subscription pls give me comparative reply among these three case.

Asked by Smitakhadayate20 | 23 Jun, 2019, 08:44: PM

We appreciate the doubt asked, however, we would request you to post a particular question with complete details for which we can provide you an appropriate solution.

To understand and solve the doubts related to subscriptions, it is necessary to understand the concept in detail and also remember the format for calculating the various related amounts.

- Meaning:

- It is a source of income for an NPO.

- It is paid by the members periodically which can be quarterly or half yearly so that their membership remains alive.

- The total amount of subscription relating to the current year, whether received or not are to be shown on the credit side of the Income and Expenditure Account.

- Amount relating to the current year, not received till the end of the year is to be shown as an asset in the Balance Sheet as outstanding income.

- Amount received in advance for future years is also shown as a liability in the Balance Sheet as advance income.

- Format: The table showing calculation of Subscriptions is given as follows:

|

Particulars |

Amount |

|

Subscription received during year as shown in Receipts and Payments Account Add: Outstanding at the end of the year Received in advance in the beginning of the year Less: Outstanding at the beginning of the year Received in advance at the end of the year |

|

|

|

|

|

Subscriptions to be shown in the Income and Expenditure A/c |

Answered by Surabhi Gawade | 24 Jun, 2019, 09:07: AM

Application Videos

Concept Videos

CBSE 12-commerce - Accountancy

Asked by joymotibarman | 15 Jan, 2024, 02:15: PM

CBSE 12-commerce - Accountancy

Asked by divyanshmaheshwari2003 | 04 Nov, 2023, 05:06: PM

CBSE 12-commerce - Accountancy

Asked by deepamonidas1234 | 21 Sep, 2023, 09:14: PM

CBSE 12-commerce - Accountancy

Asked by officialpaperio.man | 31 Jan, 2022, 09:14: AM

CBSE 12-commerce - Accountancy

Asked by swapnil292001 | 08 Nov, 2020, 11:22: AM

CBSE 12-commerce - Accountancy

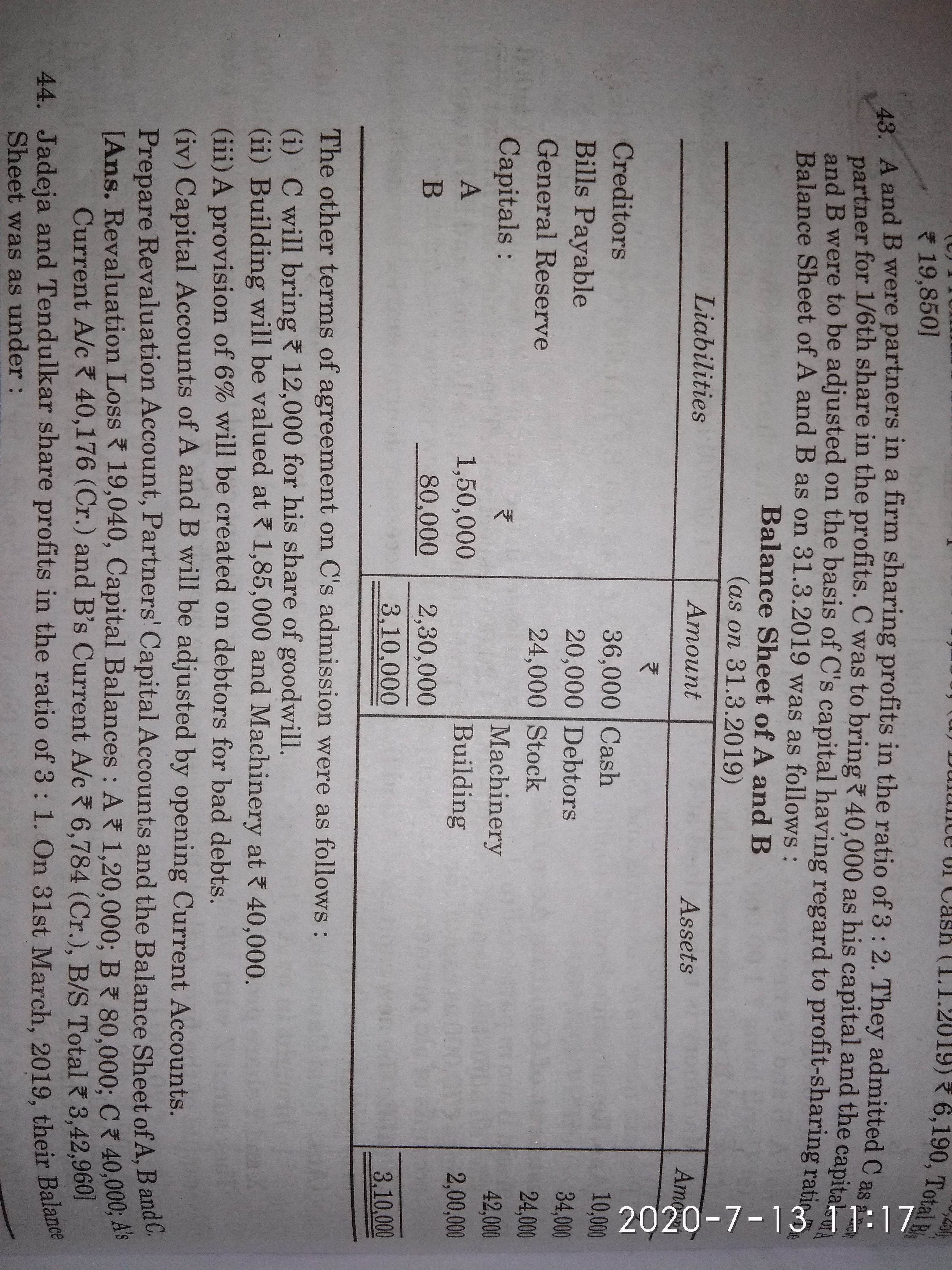

Asked by raksha2sanubth | 13 Jul, 2020, 11:22: AM

CBSE 12-commerce - Accountancy

Asked by raksha2sanubth | 13 Jul, 2020, 11:19: AM

CBSE 12-commerce - Accountancy

Asked by sonowalabhilash | 02 Jul, 2020, 09:46: AM

CBSE 12-commerce - Accountancy

Asked by simarjiv10 | 24 Jun, 2020, 11:25: PM