CBSE Class 12-commerce Answered

Subscriptions:

- It is a source of income for an NPO.

- It is paid by the members periodically which can be quarterly or half yearly so that their membership remains alive.

- The total amount of subscription relating to the current year, whether received or not are to be shown on the credit side of the Income and Expenditure Account.

- Amount relating to the current year, not received till the end of the year is to be shown as an asset in the Balance Sheet as outstanding income.

- Amount received in advance for future years is also shown as a liability in the Balance Sheet as advance income.

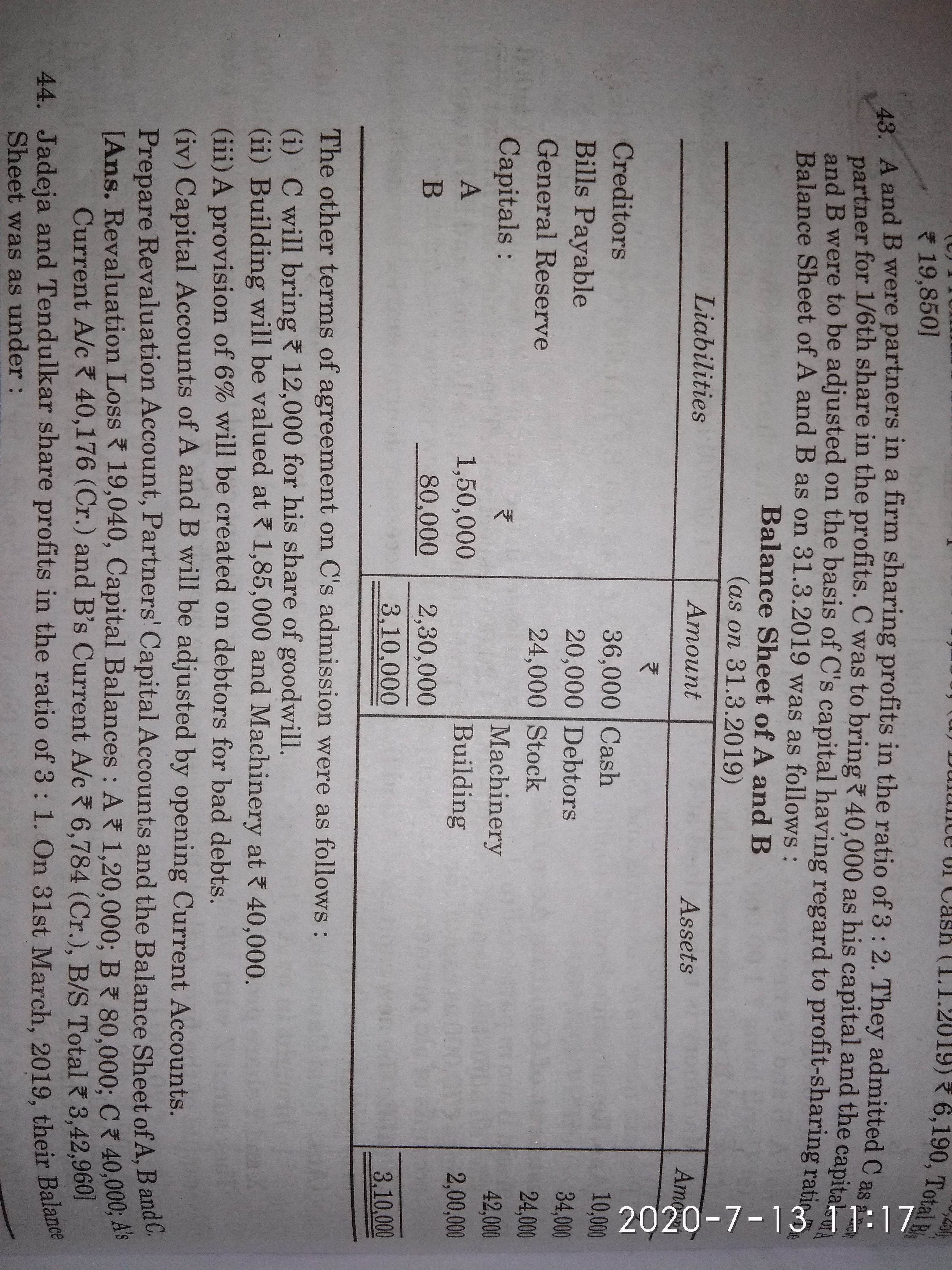

Format of the table showing calculation of Subscriptions to be shown Income and Expenditure Account is as follows:

|

Particulars |

Amount |

|

Subscription received during year as shown in Receipts and Payments Account Add: Outstanding at the end of the year Received in advance in the beginning of the year Less: Outstanding at the beginning of the year Received in advance at the end of the year |

|

|

|

|

|

Subscriptions to be shown in the Income and Expenditure A/c |