CBSE Class 12-commerce Answered

In cash flow que no 52 how we calculate proposed dividend how it is come 23000 and being add in operating activities

Asked by Smitakhadayate20 | 08 Jan, 2019, 02:57: PM

We believe you are taking about Q 53, here, the effect of proposed dividend on Cash Flow Statement is as follows:

i. proposed dividend for previous year is shown as an outflow of cash assuming that the shareholders have approved the proposed dividend. Therefore, proposed dividend for the year ended 31.03.2017 Rs.14,000 will be shown as an outflow.

ii. proposed dividend for current year is not given any effect as it is not provided for. Therefore, Rs.25,000 proposed for the current year is not given any effect in the cash flow statement.

Also, it is given in the question that interim dividend paid during the year is Rs.9,000.Therefore, total outflow with respect to dividends for the current year will be total of dividend proposed for previous year and interim dividend paid for current year which is Rs.23,000 (Rs.14,000+Rs. 9,000). Such 23,000 is therefore shown as an outflow in financing activities and added in operating activities to derive operating profits.

Also, it is given in the question that interim dividend paid during the year is Rs.9,000.Therefore, total outflow with respect to dividends for the current year will be total of dividend proposed for previous year and interim dividend paid for current year which is Rs.23,000 (Rs.14,000+Rs. 9,000). Such 23,000 is therefore shown as an outflow in financing activities and added in operating activities to derive operating profits.

Answered by | 09 Jan, 2019, 11:16: AM

Application Videos

Concept Videos

CBSE 12-commerce - Accountancy

Asked by joymotibarman | 15 Jan, 2024, 02:15: PM

CBSE 12-commerce - Accountancy

Asked by divyanshmaheshwari2003 | 04 Nov, 2023, 05:06: PM

CBSE 12-commerce - Accountancy

Asked by deepamonidas1234 | 21 Sep, 2023, 09:14: PM

CBSE 12-commerce - Accountancy

Asked by officialpaperio.man | 31 Jan, 2022, 09:14: AM

CBSE 12-commerce - Accountancy

Asked by swapnil292001 | 08 Nov, 2020, 11:22: AM

CBSE 12-commerce - Accountancy

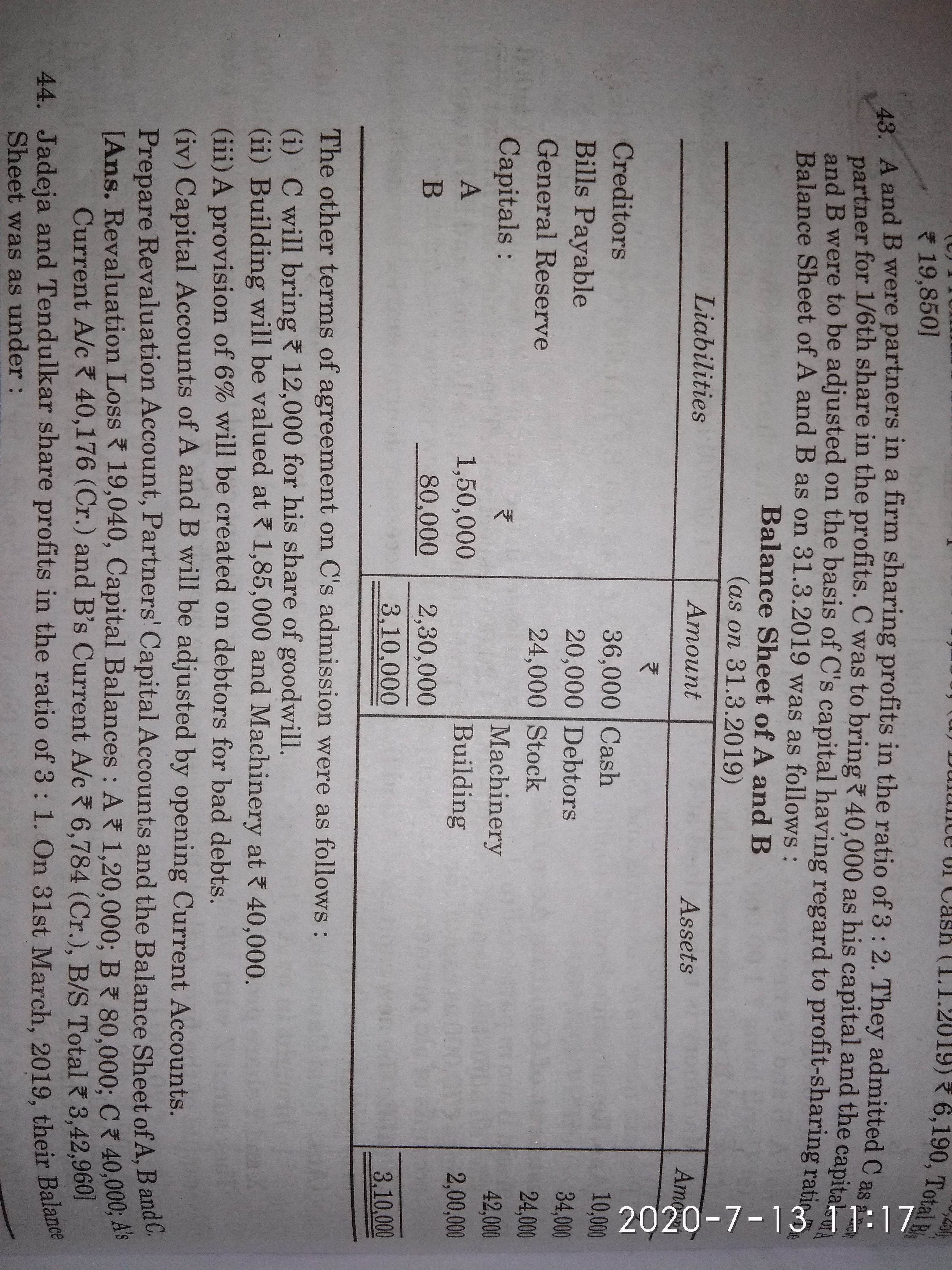

Asked by raksha2sanubth | 13 Jul, 2020, 11:22: AM

CBSE 12-commerce - Accountancy

Asked by raksha2sanubth | 13 Jul, 2020, 11:19: AM

CBSE 12-commerce - Accountancy

Asked by sonowalabhilash | 02 Jul, 2020, 09:46: AM

CBSE 12-commerce - Accountancy

Asked by simarjiv10 | 24 Jun, 2020, 11:25: PM