CBSE Class 12-commerce Answered

In cash flow que 57 what accounting treatment of dates given with additional information.a nd why we will take out intrest on debenture on 2018 year base 300000.

Asked by Smitakhadayate20 | 10 Jan, 2019, 06:41: AM

From the Balance Sheet of the company, it is evident that there is a increase in the amount of debentures of Rs.1,00,000 (3,00,000-2,00,000) from 2017 to 2018. Also, it is clearly mentioned in the additional information that such increase is on account of debentures being issued on 1st April, 2017 which is the first day of the current financial year 2017-2018. It means that the total amount of debentures of Rs.3,00,000 is available for use from the very first day of the current accounting year starting from 1st April 2017 to 31st March 2018.

Therefore, interest on such debentures will be calculated on such total amount of Rs.3,00,000 for all 12 months during 2017-18 as follows:

Interest = 3,00,000 x 10% x 12/12 = 30,000

Answered by Surabhi Gawade | 10 Jan, 2019, 01:13: PM

Application Videos

Concept Videos

CBSE 12-commerce - Accountancy

Asked by joymotibarman | 15 Jan, 2024, 02:15: PM

CBSE 12-commerce - Accountancy

Asked by divyanshmaheshwari2003 | 04 Nov, 2023, 05:06: PM

CBSE 12-commerce - Accountancy

Asked by deepamonidas1234 | 21 Sep, 2023, 09:14: PM

CBSE 12-commerce - Accountancy

Asked by officialpaperio.man | 31 Jan, 2022, 09:14: AM

CBSE 12-commerce - Accountancy

Asked by swapnil292001 | 08 Nov, 2020, 11:22: AM

CBSE 12-commerce - Accountancy

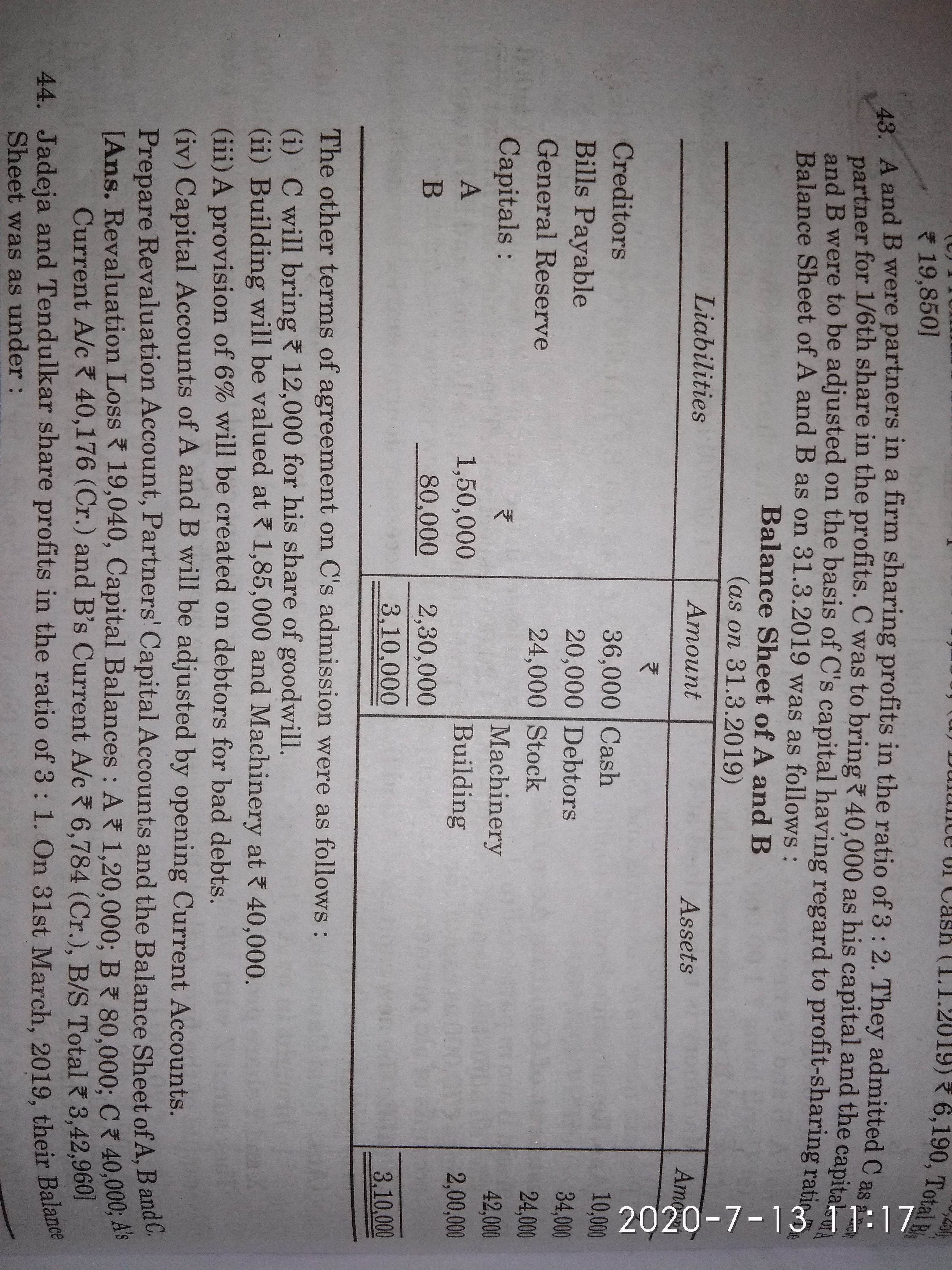

Asked by raksha2sanubth | 13 Jul, 2020, 11:22: AM

CBSE 12-commerce - Accountancy

Asked by raksha2sanubth | 13 Jul, 2020, 11:19: AM

CBSE 12-commerce - Accountancy

Asked by sonowalabhilash | 02 Jul, 2020, 09:46: AM

CBSE 12-commerce - Accountancy

Asked by simarjiv10 | 24 Jun, 2020, 11:25: PM