CBSE Class 12-commerce Answered

In accounting for partnering firms in que no 41 why we are taking profit to find out opening capital in fluctuating method only why we can't take it to find opening capital in fixed capital method in both the situation why interest on capital Anwer is different.

Asked by Smitakhadayate20 | 25 Mar, 2019, 11:05: AM

Partners’ Capital Accounts: In a partnership firm, separate Capital Accounts are maintained for each partner as each of the partners is the owner and has separate transactions with the firm. These Partners’ Capital Accounts can be maintained by following any of the 2 methods where only one account is prepared and separate columns for each of the partners are added on debit as well as the credit side of the account:

- Fixed Capital Accounts Method: In this method, the capital amount invested by each of the partner in the firm remains fixed or unaltered, unless a partner introduces additional capital or withdraws out of his or her capital. For recording all transactions other than transactions related to capital such as drawings, interest on capital, interest on drawings, salary, commission, share of profit/losses, etc. Current Accounts are maintained in addition to the Capital Accounts. Therefore, while calculating opening capital under this method, all the amounts recorded in current accounts(i.e., drawings, interest on capital, interest on drawings, salary, commission, share of profit/losses, etc.) are not considered and only those amounts which are recorded in the fixed capital account are considered.

- Fluctuating Capital Accounts Method: In this method, only one account is maintained which is the Capital Account. All the transactions related to the addition or withdrawal of capital, salary, commission, interest on capital, interest on drawings, share of profits or losses, etc. are recorded in this Capital Account only. This method is followed for maintaining Capital Accounts and therefore, in the absence of any instructions, this method should be followed for maintaining the Partners’ Capital Accounts. Therefore, while calculating opening capital under this method, all these amounts (i.e., withdrawal of capital, salary, commission, interest on capital, interest on drawings, share of profits or losses, etc.) are to be considered.

Since, the amount on which the interest is calculated is different under both situations (as explained above), the amount of interest will also be different in the both situations.

Answered by Surabhi Gawade | 25 Mar, 2019, 03:02: PM

Application Videos

Concept Videos

CBSE 12-commerce - Accountancy

Asked by joymotibarman | 15 Jan, 2024, 02:15: PM

CBSE 12-commerce - Accountancy

Asked by divyanshmaheshwari2003 | 04 Nov, 2023, 05:06: PM

CBSE 12-commerce - Accountancy

Asked by deepamonidas1234 | 21 Sep, 2023, 09:14: PM

CBSE 12-commerce - Accountancy

Asked by officialpaperio.man | 31 Jan, 2022, 09:14: AM

CBSE 12-commerce - Accountancy

Asked by swapnil292001 | 08 Nov, 2020, 11:22: AM

CBSE 12-commerce - Accountancy

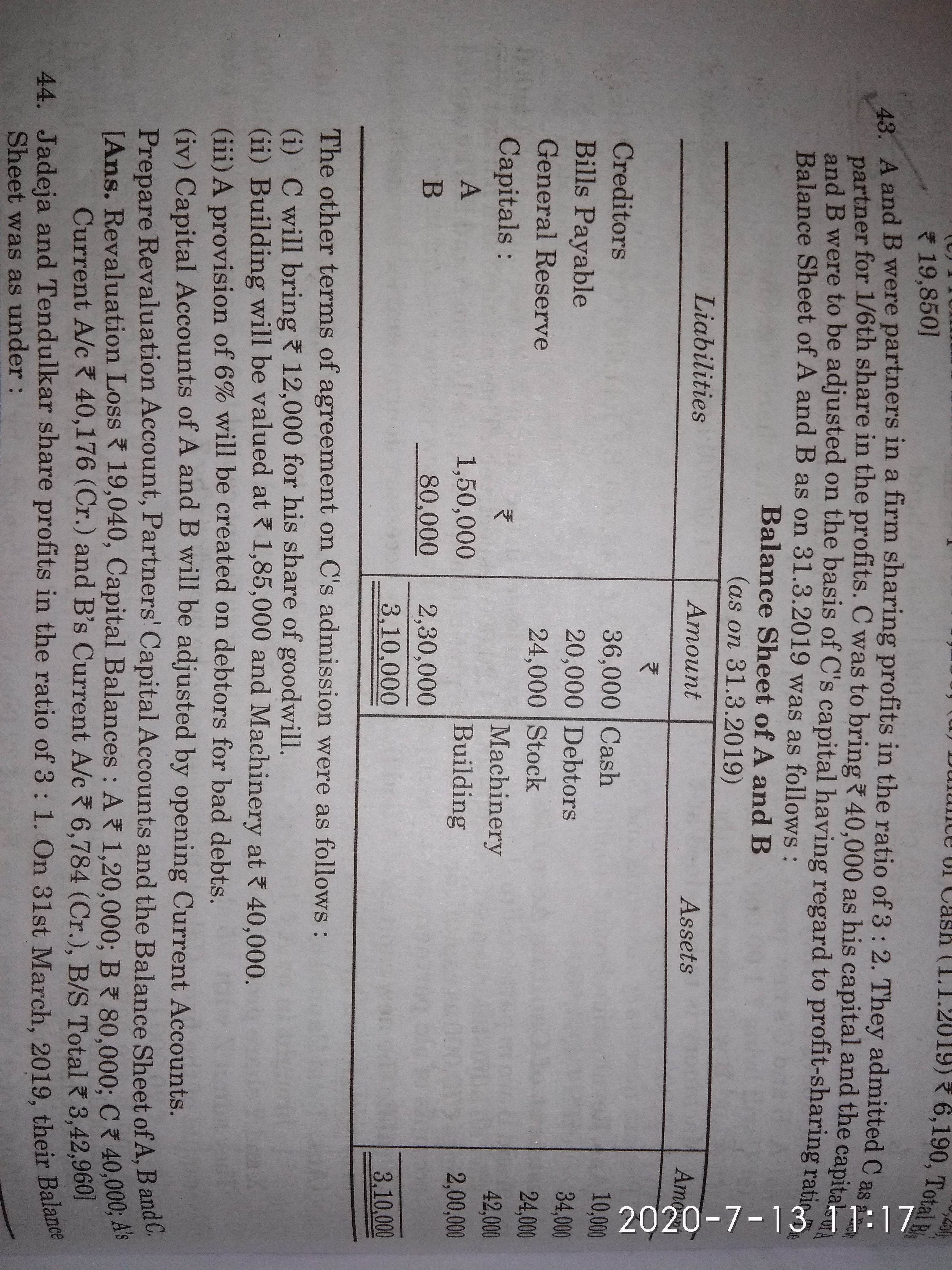

Asked by raksha2sanubth | 13 Jul, 2020, 11:22: AM

CBSE 12-commerce - Accountancy

Asked by raksha2sanubth | 13 Jul, 2020, 11:19: AM

CBSE 12-commerce - Accountancy

Asked by sonowalabhilash | 02 Jul, 2020, 09:46: AM

CBSE 12-commerce - Accountancy

Asked by simarjiv10 | 24 Jun, 2020, 11:25: PM