ICSE Class 10 Answered

Calculation of Interest on savings bank account: In the saving bank account the interest is paid on the minimum balance between 10th and the last day of the month. The minimum balance between 10th and the last day of a month is generally called the qualifying amount for the particular month. The qualifying amount is taken as multiple of Rs. 10. If the minimum balance is Rs. 355 or less, then the qualifying amount is Rs. 350, but if it is more than Rs. 355 and less than or equal to Rs. 360 then the qualifying amount is Rs. 360. If the minimum balance is Rs. 5 or less, then, no interest is paid for that month. The following stepwise method explains the procedure for computing interest on saving bank account.

Method :

Step I. Write down the minimum balance between 10th and the last date of each month in a multiple of 10.

Step II. To find the principal amount add all these balances for one month.

Step III. Find simple interest on this sum for one month using the formula

I =P*R*T / 100

where T = 1/12 year.

and R = Rate of interest

P = Principal or sum of the amount

Step IV. If the total interest is less than Re. 1, neglect it and take it 0.

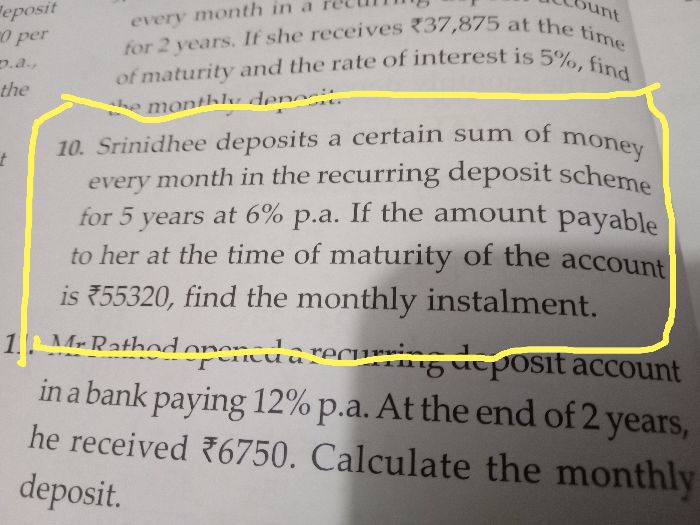

Calculation of Interest on recurring Deposit Account : Here, a depositor opening his account chooses a specified amount (normally) a multiple of Rs. 5 and deposits that amount in this account every month for a period chosen by him/her at the time of opening the account. This period may range from 12 months to 10 years. At the expiry of this period, the depositor gets the amount deposited by him/her together with the interest, compounded quarterly at a fixed rate. This rate of interest is revised from time to time.

Interest is calculated as under :

Interest = MD*T*r/100

Where M.D. denotes amount of monthly deposit, T = n(n+1)/2*12 years (n being the number of months, M.D. is paid) and r is the rate of interest.

At the time of maturity (or at the end of the specified period), the depositor will get the following amount:

Total deposit (M.D.* n) + Interest.