CBSE Class 11 Commerce Accountancy Part Ii Free Doubts and Solutions

CBSE - XI Commerce - Accountancy Part II

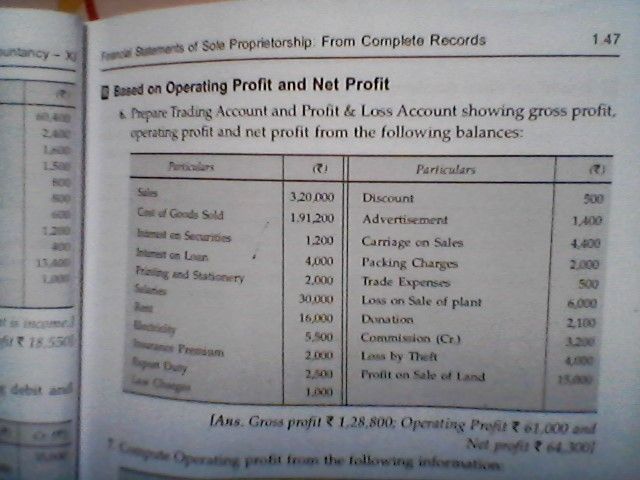

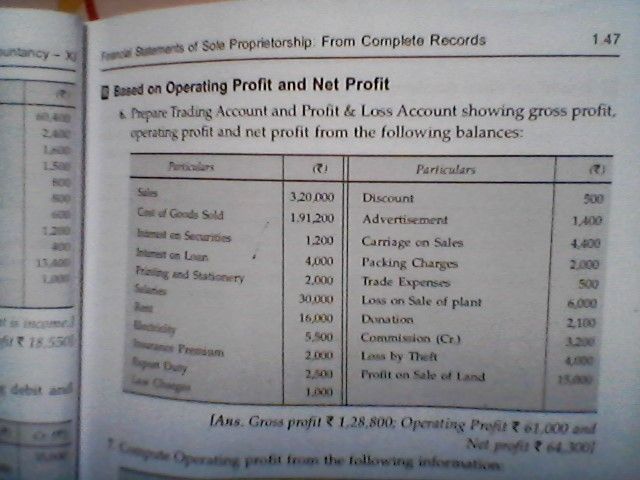

6. prepare trading account and rrofit and loss account

For Franchisee Enquiry

or

You are very important to us

For any content/service related issues please contact on this number

93219 24448 / 99871 78554

Mon to Sat - 10 AM to 7 PM