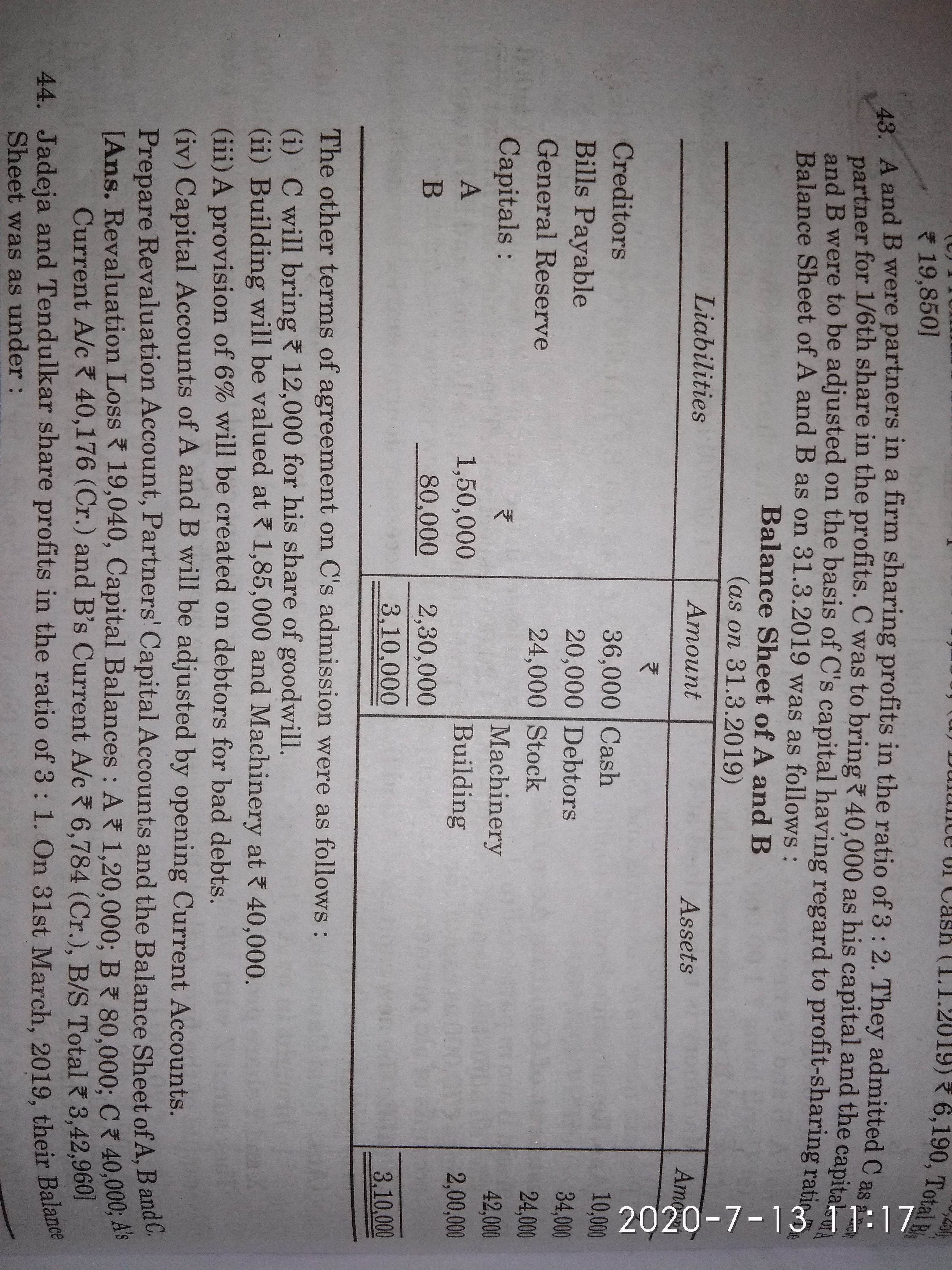

CBSE Class 12-commerce Answered

|

Sr. |

Circumstances |

Calculation of Interest |

|

1 |

If amount of drawings are drawn at the beginning of every month. |

Interest is charged on the whole amount for 6 and a half (6.5) months at an agreed rate per annum.

|

|

2 |

If amount of drawings is drawn as a fixed sum in the middle of every month. |

Interest is charged on the whole amount for 6 months at an agreed rate per annum.

|

|

3 |

If amount of drawings is drawn as a fixed sum at the end of every month. |

Interest is charged on the whole amount for 5 and a half (5.5) months at an agreed rate per annum.

|

|

4 |

If amount of drawings is drawn as fixed sum in the beginning of each quarter. |

Interest is charged on the whole amount for a period of 7 and a half (7.5) months at an agreed rate per annum.

|

|

5 |

If the partner withdraws a fixed sum in the middle of each quarter. |

Interest is charged on the whole amount for a period of 6 months at an agreed rate per annum. |

|

6 |

If the partner withdraws a fixed sum at the end of each quarter. |

Interest is charged on the whole amount for a period of 4 and a half (4.5) months at an agreed rate per annum. |

|

7 |

If the partner withdraws unequal amount on different dates. |

Interest is calculated using simple method or product method. |

|

8 |

If dates of drawings are given and the interest is to be charged at an agreed rate per annum. |

Interest is calculated on the basis of time. |

|

9 |

If the date of withdrawal is not given. |

Interest on total drawings for the year is calculated for six months on the average basis. |

|

10 |

If the rate of interest is given without the word ‘per annum.’ |

Interest is charged without considering the time factor. |

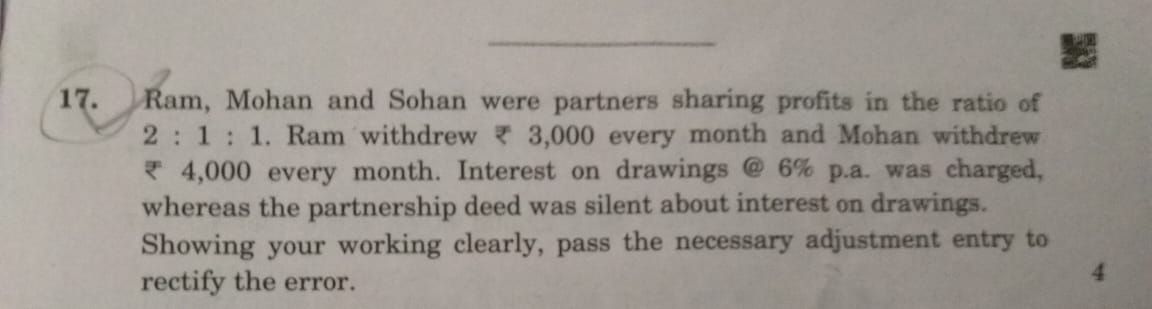

Complete solutions along with the detailed workings for all similar questions on adjustment entries are provided on our website under Text Book Solutions