CBSE Class 11-commerce Answered

An old machinery is sold to mansh for 50000 name the book in which this entry will be recorded

Asked by Manalshameem123 | 16 Sep, 2019, 01:36: AM

A Journal Proper records all the transactions which cannot be recorded in any other subsidiary book prepared by the business which may be cash book, purchases book, purchases return book, sales book, sales return book, bills receivable book and bills payable book. For example, credit purchases of fixed assets, goods distributed as free sample, credit sales of fixed assets and depreciation on fixed assets.

Since, in the mentioned statement, Machinery has been sold to Mansh for Rs. 50,000 and no details of the payment made have been specified, it is considered as a credit sale of Machinery and therefore, recorded in the Journal Proper.

Answered by Surabhi Gawade | 16 Sep, 2019, 11:26: AM

CBSE 11-commerce - Accountancy

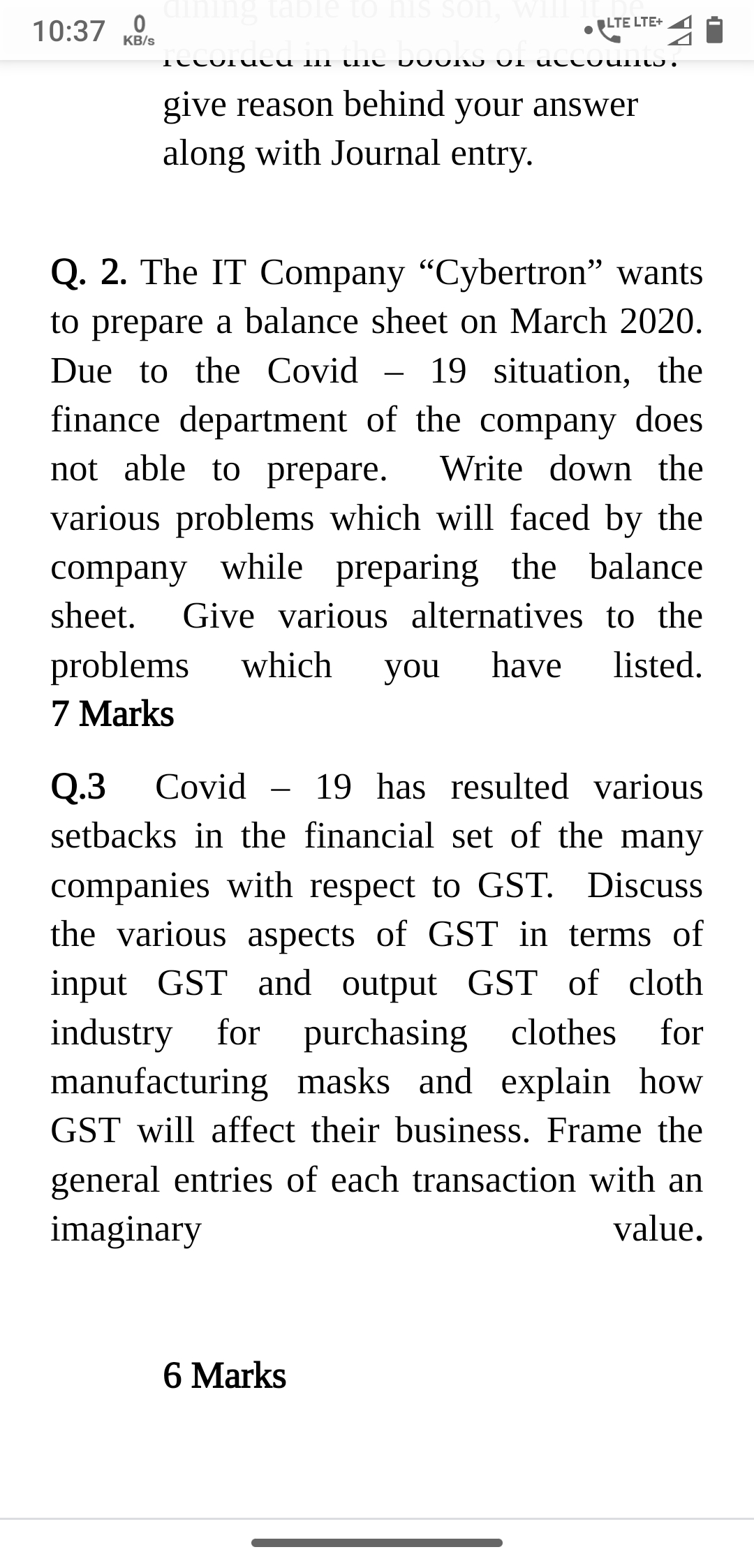

Asked by pradyumnaagrawal2957 | 10 Jun, 2021, 10:59: AM

CBSE 11-commerce - Accountancy

Asked by kumarimanisha.9767 | 21 Jul, 2020, 10:32: AM

CBSE 11-commerce - Accountancy

Asked by tussharpoddar7 | 08 Jul, 2020, 11:30: PM

CBSE 11-commerce - Accountancy

Asked by lovermahakal942004 | 08 Jul, 2020, 01:51: PM

CBSE 11-commerce - Accountancy

Asked by tyagiji2511 | 24 Jun, 2020, 10:45: AM

CBSE 11-commerce - Accountancy

Asked by pdas93679 | 23 Jun, 2020, 08:22: AM

CBSE 11-commerce - Accountancy

Asked by agrawalgaurav441 | 12 Jun, 2020, 01:55: PM

CBSE 11-commerce - Accountancy

Asked by boparaijaideep23 | 05 Jun, 2020, 11:07: AM

CBSE 11-commerce - Accountancy

Asked by Lashmibasra | 18 May, 2020, 04:10: PM

CBSE 11-commerce - Accountancy

Asked by himanshu2002tejas | 16 Apr, 2020, 11:16: PM