CBSE Class 12-commerce Answered

ajay, vijay and sanjay are partners sharing profit and loss in the ratio of 2:3:1. The balance sheet of the firm as on 31.03.2015 is as follows:Liabilitiescapital vijay 85000, sanjays capital 68000, gr 30000, sc 25000AssetsF&F 30000, Office Equipment 20000, motor car 60000, stock 40000, sd 20000, cash at bank 18000, ajay`s capital 20000.Kamal is admitted as a new partner with effect from 1.4.2015 by receiving 1\4 share in the profit and loss of the firm.. The proift or loss sharing ratios between other partners remain same as before. It was agreed that kamal would bring some private furniture worth rs.3000 and private stock worth rs.5000 and balance in cash towards his capital.2. motor car is takenover by vijay at 700003. office equipment is revalued at 250004. expenses incurred but not paid of rs 6500 are provided for 5. value of the stock is to be reduced by 5%6 kamal is to bring proportionate capital, capital of vijay. Ajay and sanjay are also to be adjusted in profit sharing ratio.7 goodwill of the firm is to be valued at 2 years purchase of the average profit of last 3 years. the profits for the last 3 years were rs 35900, 38200 and 31500. However on checking of the past records it was noticed that on 1.4.2011 a new furniture costing rs 8000 was purchased but wrongly debited to revenue and also in year 2012-2013. a purchase invoice of rs 4000 has been omitted in the book. The firm charged depreciation on furniture@10% on original cost. your calculation of goodwill is to be made on the basis of correct profits. It is agreed among existing partners that sanjays interest in the goodwill of the firm is only up to value of rs.42000.

Asked by sg637103 | 19 May, 2019, 02:54: PM

The question asked is from the chapter Admission of a Partner where a partner has been admitted and necessary adjustments are required to given effect for at the time of his admission. Complete solutions with necessary workings are available for similar type of questions on our website at the below mentioned link:

This will surely help you understand the concept and solve similar questions.

Answered by Surabhi Gawade | 20 May, 2019, 09:19: AM

Application Videos

Concept Videos

CBSE 12-commerce - Accountancy

Asked by joymotibarman | 15 Jan, 2024, 02:15: PM

CBSE 12-commerce - Accountancy

Asked by divyanshmaheshwari2003 | 04 Nov, 2023, 05:06: PM

CBSE 12-commerce - Accountancy

Asked by deepamonidas1234 | 21 Sep, 2023, 09:14: PM

CBSE 12-commerce - Accountancy

Asked by officialpaperio.man | 31 Jan, 2022, 09:14: AM

CBSE 12-commerce - Accountancy

Asked by swapnil292001 | 08 Nov, 2020, 11:22: AM

CBSE 12-commerce - Accountancy

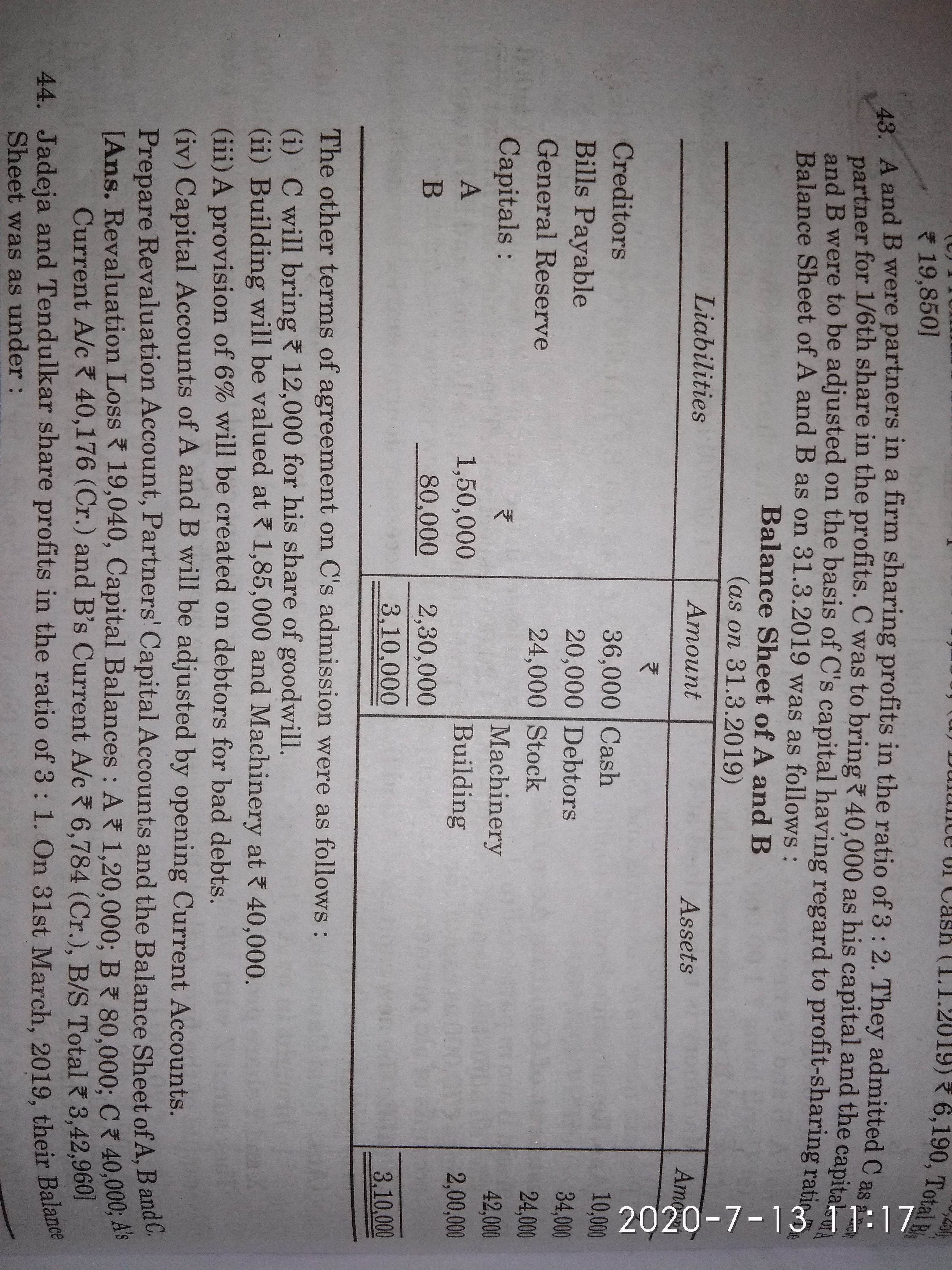

Asked by raksha2sanubth | 13 Jul, 2020, 11:22: AM

CBSE 12-commerce - Accountancy

Asked by raksha2sanubth | 13 Jul, 2020, 11:19: AM

CBSE 12-commerce - Accountancy

Asked by sonowalabhilash | 02 Jul, 2020, 09:46: AM

CBSE 12-commerce - Accountancy

Asked by simarjiv10 | 24 Jun, 2020, 11:25: PM