ICSE Class 10 Answered

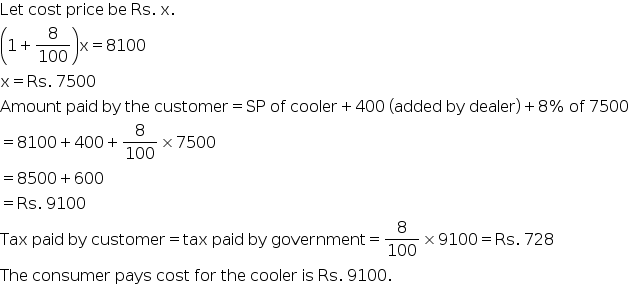

A manufacturing company p sells a desert cooler to a dealer A for Rs.8100 including sales tax (under VAT). the dealer A sells it to a dealer B for Rs.8500 plus sales tax and the dealer B sells it to a consumer at a profit of Rs.600. if the rate of sales tax (under VAT) is 8%,find

1)cost price of the cooler for the dealer A

2)the amount of tax recieved by the govt.

3)the amount which the consumer pays for the cooler

Asked by sukhmani281 | 05 Feb, 2018, 02:25: PM

Answered by Sneha shidid | 05 Feb, 2018, 05:30: PM