ICSE Class 10 Answered

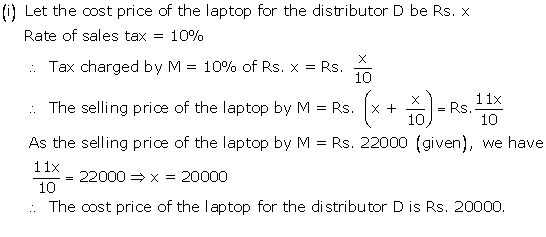

A manufacturing company M sells a laptop to a distributor D for Rs. 22000 including sales tax. The distributor D sells it to a retailer R for Rs. 21750 excluding tax and the retailer sells it to a consumer for Rs. 23400 plus tax. If the rate of sales tax (under VAT) is 10%, find

The cost price of the laptop for the distributor D.

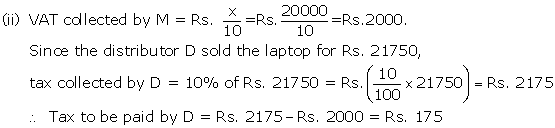

The amount of tax (under VAT) paid by D.

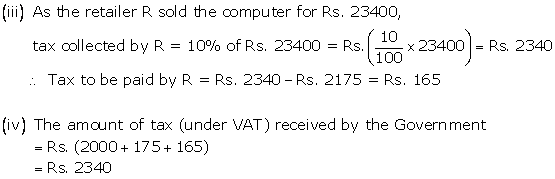

The amount of tax (under VAT) paid by R.

The amount of tax received by the State Government on the sale of this laptop.

Asked by Topperlearning User | 01 Sep, 2017, 02:36: PM

Answered by | 01 Sep, 2017, 04:36: PM