Is GST Troubling You?

This blog gives a complete idea of what is GST, types of GST, why is GST implemented, also explained with a proper example which is useful for a student in ICSE Class 10 who has this topic in Maths syllabus.

By Yasmeen Khan 12th Nov, 2019 | 06:29 pm

ShareThe Government of India levies two types of taxes on its citizens:

Direct taxes are imposed on the income of organisations or individuals. For example, corporate tax and income tax.

Indirect taxes are paid by organisations or consumers when they buy goods or services or both. For example, VAT, excise and service tax etc.

The government collects money through these taxes within their respective territories for welfare and development schemes, administrative expenses, salaries of government employees etc.

From 1st July 2017, the Government of India abolished all indirect taxes and introduced a new indirect tax called GST.

Hence the ICSE board has removed VAT chapter from the ICSE Class 10 Maths syllabus and added GST.

- Goods and Services Tax (GST) is a comprehensive tax levied on the manufacture, sale and consumption of goods and services at the national level.

- GST is a consumption-based tax which is imposed when an individual or organisation buys/transfers goods or services or both.

- It is collected on the value added at each stage of sale or purchase in the supply chain.

- GST has replaced all former indirect taxes levied by the central and state governments.

- GST is applicable throughout India except in Jammu and Kashmir.

Why is GST implemented?

- The aim of the government in implementing GST is one nation, one tax.

- It brings uniformity in the rates of taxation on goods and services and removes disparity of taxes in different states throughout the country.

- It avoids the cascading effect (i.e. tax on tax or double taxation) and removes multiplicity of taxes (i.e. products on which more than one tax was charged simultaneously).

- It minimises the physical interface between the taxpayer and the tax authorities and hence reduces the taxpayer’s difficulties.

So basically,

Tax deposited with the government

= GST collected – GST paid

= GST on sale price – GST on purchase price

= GST on (sale price – purchase price)

= GST on value addition

- Those who charge GST have to mention their GST registration number on the bill.

- An end user (a consumer) cannot claim GST paid by him/her.

- GST can be charged or collected on the sale/transfer of goods and services by a person or an organisation who/which is already registered with GST.

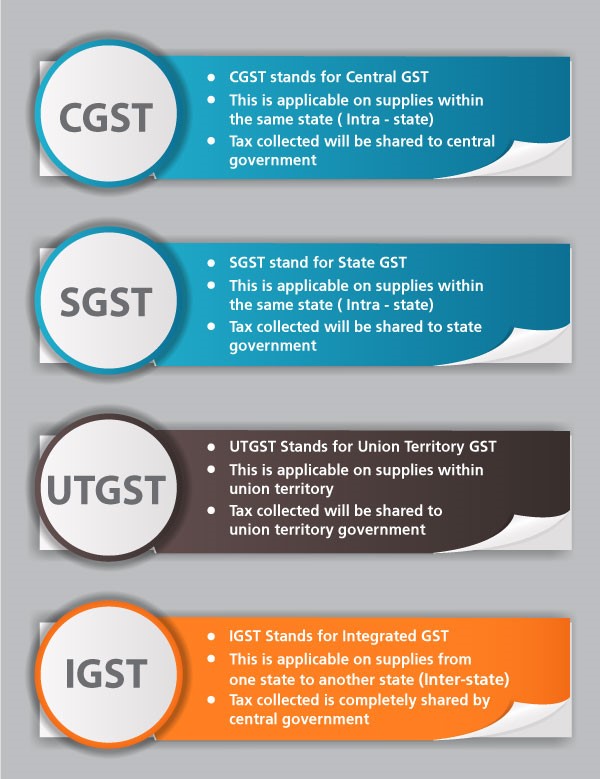

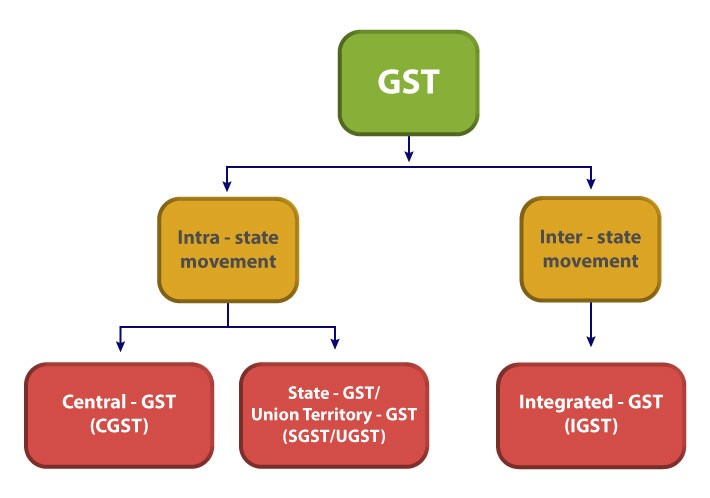

GST comprises of:

Remember:

- In the intra-state transaction of goods and services, the tax collected is to be shared equally by the central government and the state government.

- In the inter-state transaction of goods and services, the tax collected is shared by only the central government.

Let us see some examples which involve the calculation of GST.

- For the following transactions, find the bill amount.

- Within Delhi:

MRP = Rs. 12,000, Discount% = 30%, GST = 18%

Solution:

Discount = 30% of 12,000 =

Selling price = 12,000 – 3,600 = Rs. 8,400

Since the transaction is intra-state, i.e. within Delhi.

CGSTand SGST are applicable.

The percentage is divided equally between CGST and SGST.

CGST = 9% of 8,400 =

SGST = 9% of 8,400 =

IGST = 0

Bill Amount = Selling price + CGST + SGST = 8,400 + 756 + 756 = Rs. 9912

2. From Delhi to Jaipur:

MRP = Rs. 50,000, Discount% = 20%, GST = 28%

Solution:

Discount = 20% of 50,000 =

Selling price = 50,000 – 10,000 = Rs. 40,000

Since the transaction is inter-state, i.e. from one state (Delhi) to another state (Jaipur), only IGST is applicable.

CGST = 0

SGST = 0

IGST = 28% of 40,000 =

Bill Amount = Selling price + IGST = 40,000 + 11,200 = Rs. 51,200

Another feature of GST is ITC which means Input Tax Credit.

If a person or an organisation is paying tax on sale (output) of goods/services, then they can avail the tax which they have already paid on the purchase (input) of these goods/services and pay only the balance amount as tax.

- Input tax includes CGST/SGST/IGST paid on input goods/services.

- The credit of input tax charged on supply of goods/services is entitled to only a registered person.

- Under GST, credit tax paid on every input used for the supply of taxable goods/services/both is allowed.

- ITC is not available for liquor, petrol, petroleum products, diesel, motor spirit etc.

- ITC can be availed only on goods/services for business purposes.

Zero-rated transaction in GST:

In exports of goods/services, GST is not payable but still ITC is available.

Let us see the concept of ITC with an interesting example.

Question:

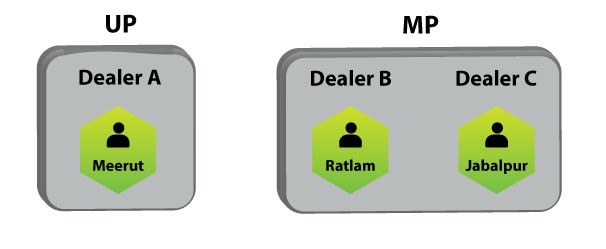

A is a dealer in Meerut (UP). He supplies goods/services worth Rs. 15,000 to a dealer B in Ratlam (MP). Dealer B in turn supplies the same goods/services to a dealer C in Jabalpur (MP) at a profit of Rs. 3,000. If the rate of tax (under GST system) is 18%, find

(i) the cost of goods/services for dealer C in Jabalpur

(ii) net tax payable by dealer B

Solution:

For dealer A:

Selling price = Rs. 15,000

For dealer B:

Cost price = Rs. 15,000

Only IGST is applicable as the supply is from one state (UP) to another state (MP).

IGST = 18% of 15,000 =

Input tax for B = Rs. 2,700 = Output tax for A

Selling price = 15,000 + 3,000 = Rs. 18,000

For dealer C:

Cost price = Rs. 18,000

Here, CGST and SGST are applicable as the supply is within the same state, i.e. from Ratlam to Jabalpur in MP.

CGST = 9% of 18,000 = Rs. 1620

SGST = 9% of 18,000 = Rs. 1620

Input tax for C = Output tax for B = 1620 + 1620 = Rs. 3240

(i) Cost of goods/services for dealer C in Jabalpur = 18,000 + 1620 + 1620

= Rs. 21,240

(ii) Net tax payable by dealer B = Output tax for B – Input tax for B

= 3,240 – 2,700

= Rs. 540

These examples clearly explain the idea of a three-stage GST transaction. The point to remember here is to keep the tax calculation separate at all stages to avoid confusion.

Follow the below skeleton:

Stage 1:

Selling price = Cost price + Profit

Stage 2:

Cost price = Selling price of Stage 1

Input tax = GST calculation (w.r.t. Cost price) … This is output tax for Stage 1.

Selling price = Cost price + profit … Don’t add GST amount here.

Stage 3:

Cost price = Selling price of Stage 1

Input tax = GST calculation (w.r.t. Cost price) … This is output tax for Stage 2.

So, Net tax payable at Stage 2 = output tax for Stage 2 − input tax for Stage 2.

With all of these examples, we hope your GST-related troubles vanish soon.

If you have any query related to the concept of GST please do visit Topper Learning.

More from Education

Important Resources

- Education Franchisee opportunity

- NCERT Solution

- CBSE Class 9 Mathematics

- NCERT Solutions for class 10 Science

- Sample Papers

- CBSE Class 9 Science

- NCERT Solutions for class 10 Maths

- Revision Notes

- CBSE Class 10 Hindi

- CBSE Class 10 English

- CBSE Class 10 English

- CBSE Class 10 Social Studies

- CBSE Class 10 Science

- CBSE Class 10 Mathematics

- Career In Science After 10

- Career In Commerce After 10

- Career In Humanities/Arts After 10

- NCERT Solutions for Class 10

- NCERT Solutions for Class 11

- Business Studies Class 12 CBSE project