ICSE Class 10 Answered

mr abdul a manufacturer sells his product worth Rs 225000 within the state. he buys goods worth Rs 120000 within the state. If the rate os GST is @ 12% on the raw material and @ 18% on the finished product find the amount of GST he has to pay

Asked by ayushavs3135 | 26 Mar, 2020, 10:47: AM

Abdul buys raw material worth Rs. 120000

GST paid on the raw material = 12% of 120000

= 12/100 x 120000 = Rs. 14400

Abdul buys raw material to make it finished product

Abdul sells his product worth Rs. 225000

GST Received by abdul on finished product = 18% of 225000

= 18/100 x 225000 = Rs. 40500

Total amount of GST paid by Abdul = 40500 - 14400 Rs. 26100

Answered by Renu Varma | 26 Mar, 2020, 11:16: AM

Concept Videos

ICSE 10 - Maths

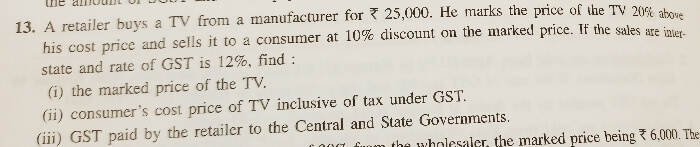

Asked by kabitanjalibehera5 | 20 Dec, 2023, 05:46: PM

ICSE 10 - Maths

Asked by sagarmishra | 25 May, 2023, 09:08: AM

ICSE 10 - Maths

Asked by varma.renu9481 | 05 Apr, 2023, 11:57: AM

ICSE 10 - Maths

Asked by varma.renu9481 | 05 Apr, 2023, 11:56: AM

ICSE 10 - Maths

Asked by varma.renu9481 | 03 Apr, 2023, 11:18: AM

ICSE 10 - Maths

Asked by varma.renu9481 | 03 Apr, 2023, 11:15: AM

ICSE 10 - Maths

Asked by nishkamiglani | 28 Mar, 2023, 10:09: PM

ICSE 10 - Maths

Asked by anupamakanojia12 | 18 Mar, 2023, 05:49: PM