CBSE Class 12-commerce Answered

if the deed is silent interest at the rate of 6% p.a would be charged on the drawings made by the partners true or false

Asked by sonowalabhilash | 02 Jul, 2020, 09:46: AM

Provisions of the Indian Partnership Act, 1932 shall be applicable when there is no Partnership Deed or if the Partnership Deed is silent. Following are the matters for which provisions of this Act shall be applicable, if the partnership deed is silent on the same:

i. Sharing of Profits/Losses: Profits/Losses are shared equally by the partners.

ii. Interest on Capital: No such interest on capital is allowed to partners.

iii. Interest on Drawings: No such interest on drawings is charged from partners.

iv. Interest on Advance/Loan by a Partner: Interest shall be paid at the rate of 6%p.a. Such interest shall be payable even if there is a loss from business as it is a charge against profit.

v. Remuneration to Partners: No partner shall be paid such remuneration as salary, commission, etc. if the partnership deed is silent on such matter.

vi. Liabilities of Partners: Subject to agreement among the partners:

Profit from a similar business: In case if a partner earns profit from a business that is similar to that of the firm in competition with the firm, then such profit earned from such business shall be paid to the firm.

Profit earned for self from firm’s business: In case if the partner earns profit for self from any business transaction of the firm or from the use of firm’s property or business connection, the profit so earned shall be paid to the firm.

Answered by Surabhi Gawade | 02 Jul, 2020, 11:50: AM

Application Videos

Concept Videos

CBSE 12-commerce - Accountancy

Asked by joymotibarman | 15 Jan, 2024, 02:15: PM

CBSE 12-commerce - Accountancy

Asked by divyanshmaheshwari2003 | 04 Nov, 2023, 05:06: PM

CBSE 12-commerce - Accountancy

Asked by deepamonidas1234 | 21 Sep, 2023, 09:14: PM

CBSE 12-commerce - Accountancy

Asked by officialpaperio.man | 31 Jan, 2022, 09:14: AM

CBSE 12-commerce - Accountancy

Asked by swapnil292001 | 08 Nov, 2020, 11:22: AM

CBSE 12-commerce - Accountancy

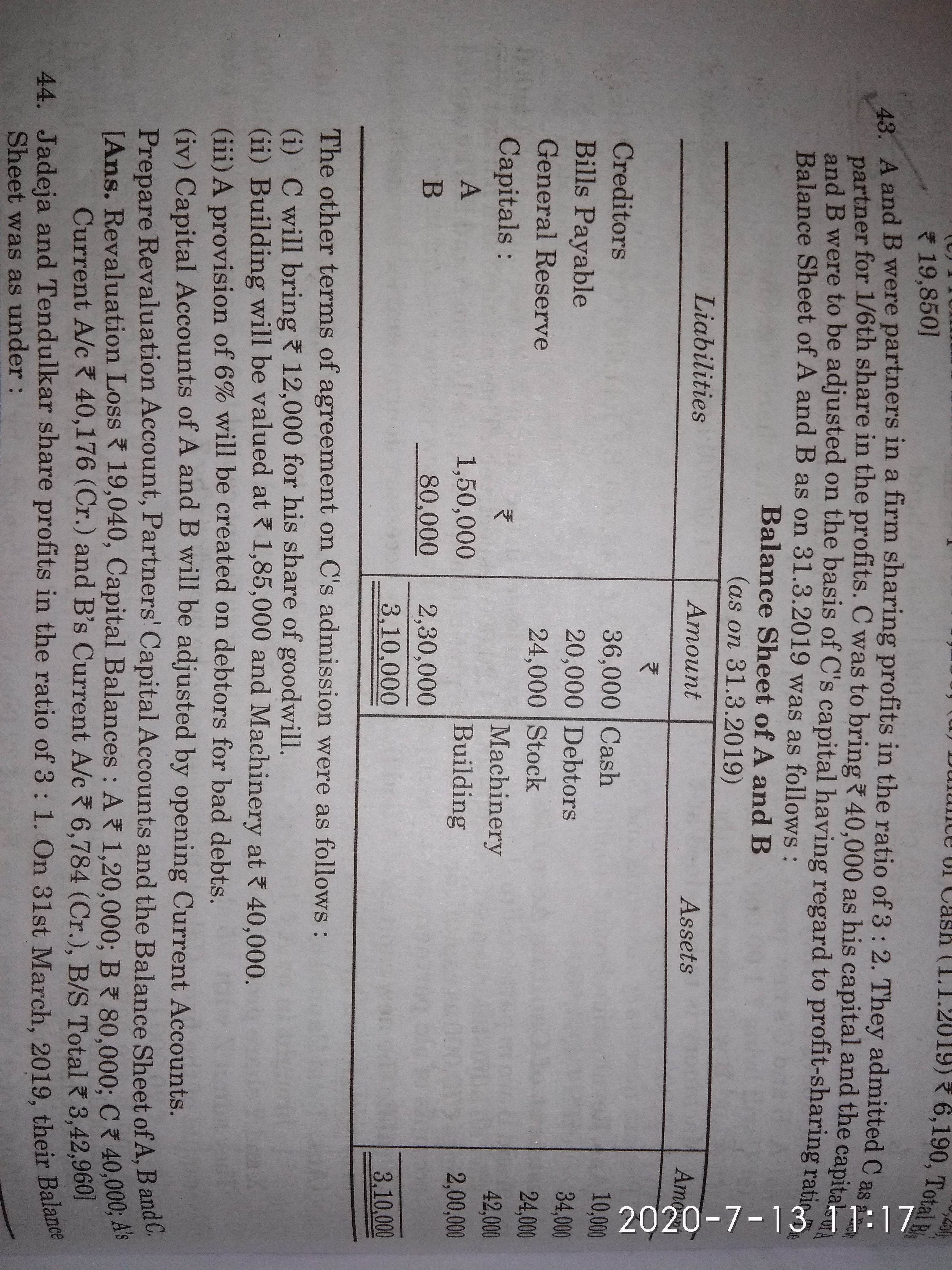

Asked by raksha2sanubth | 13 Jul, 2020, 11:22: AM

CBSE 12-commerce - Accountancy

Asked by raksha2sanubth | 13 Jul, 2020, 11:19: AM

CBSE 12-commerce - Accountancy

Asked by sonowalabhilash | 02 Jul, 2020, 09:46: AM

CBSE 12-commerce - Accountancy

Asked by simarjiv10 | 24 Jun, 2020, 11:25: PM